Payday Loans: Quick Funds for Emergencies

Wiki Article

Understanding Installment Loans: Key Realities and Features You Should Know

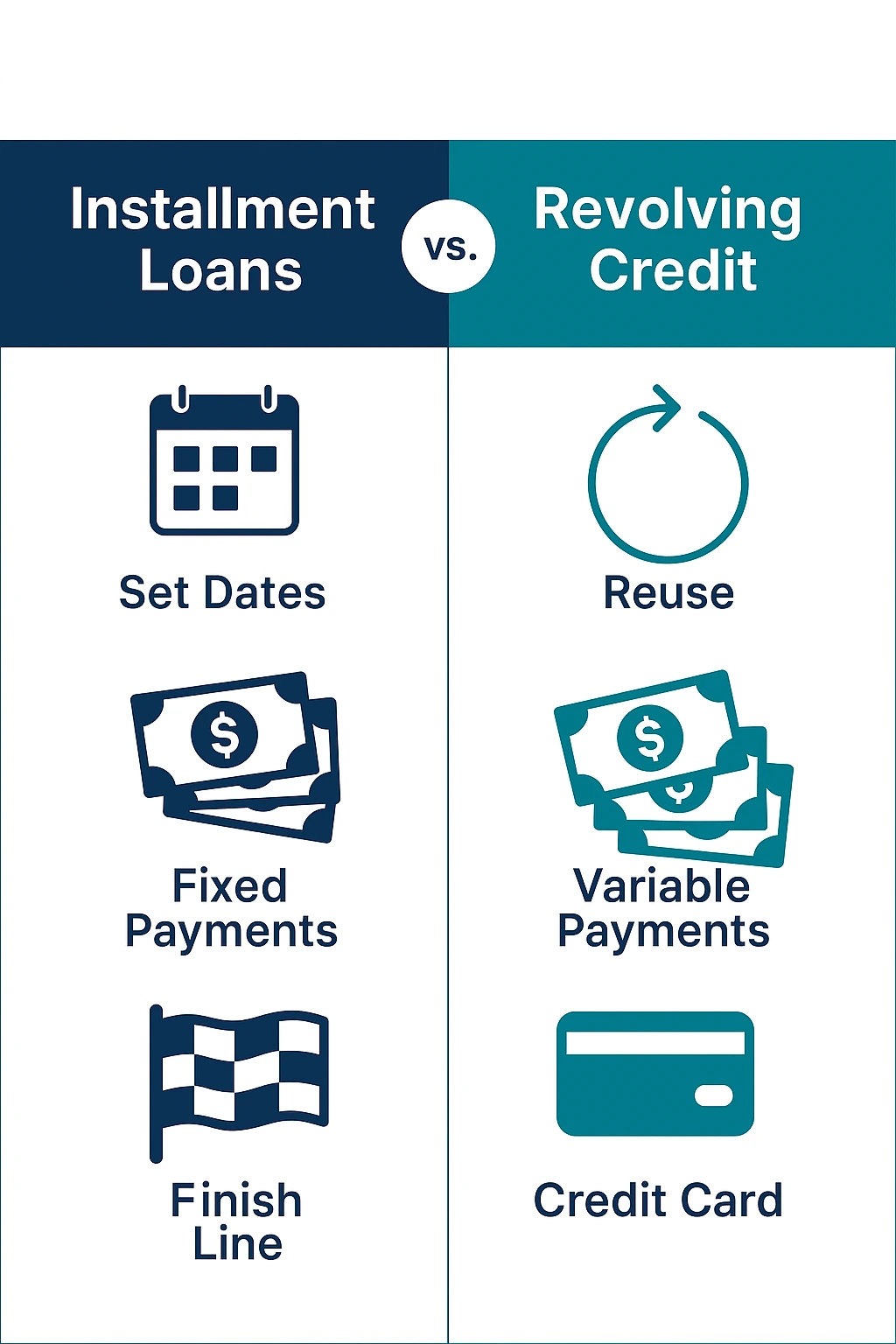

Installation car loans are a common monetary tool that numerous individuals run into - Payday Loans. They use customers a lump sum that is settled in taken care of monthly payments over a specific duration. Comprehending their structure and implications is essential for making enlightened economic decisions. As consumers take into consideration these car loans for considerable expenses, numerous aspects come into play. What are the crucial details and potential pitfalls that a person should understand before devoting to an installment finance?What Are Installment Loans?

Installation finances are a kind of funding that enables borrowers to get a round figure of cash upfront, which they then repay over a collection duration with scheduled repayments. Usually, these car loans come with set rate of interest, guaranteeing that monthly settlements stay consistent throughout the payment term. Consumers may make use of installment car loans for numerous purposes, including purchasing a car, moneying home improvements, or settling debt. The payment terms can vary, usually varying from a couple of months to numerous years, relying on the loan provider and the amount obtained.Before securing an installation funding, individuals must review their financial situation and capability to make routine settlements. This sort of funding can aid build credit rating if payments are made on time. Failing to fulfill settlement responsibilities can lead to negative consequences, consisting of boosted financial debt and a damaged credit history score, making it crucial for consumers to approach these financings with caution and consideration.

Kinds of Installment Loans

Various kinds of installation loans satisfy various financial needs and situations. Individual finances are among the most usual, using individuals the adaptability to use funds for various objectives, such as debt loan consolidation or unexpected expenditures. Vehicle fundings specifically finance lorry acquisitions, allowing consumers to spend for their autos over time. Home equity finances enable property owners to obtain versus their residential or commercial property's equity, often utilized for home improvements or major expenses. Pupil car loans aid finance education, with various payment alternatives tailored to graduates' revenue levels. Furthermore, clinical lendings supply financial help for healthcare costs, usually with positive terms. Ultimately, specialized finances, such as vacation or wedding event loans, serve specific niche demands, enabling consumers to fund unforgettable experiences. Each kind of installation lending attributes one-of-a-kind conditions, making it essential for consumers to assess their individual scenarios before picking the most suitable option.Exactly How Installment Loans Work

Comprehending just how installment fundings function is essential for debtors. The process begins with a funding application, complied with by a plainly defined repayment structure and rates of interest that affect the general cost. Each of these components plays a critical duty in establishing the usefulness and cost of the finance.Lending Application Process

When looking for an installation finance, borrowers have to browse an organized application process that normally begins with collecting needed monetary details. This consists of details concerning income, employment, and existing financial obligations, which loan providers make use of to analyze credit reliability. Next off, customers fill in a lending application, supplying individual details and the wanted car loan quantity. Lenders might need documentation, such as pay stubs or financial institution declarations, to confirm the information provided. As soon as sent, the loan provider evaluates the application, reviews the borrower's credit report, and figures out qualification. If approved, the consumer receives a financing offer outlining terms, passion rates, and payment problems. Customers should very carefully evaluate the offer before approving, ensuring it meets their financial requirements and abilities.Repayment Framework Clarified

Although the specifics of repayment can vary by lending institution, installation fundings usually include a straightforward structure that involves taken care of monthly payments over an established period. Debtors obtain a swelling sum upfront and concur to pay off the overall amount, plus any kind of relevant costs, over a set term, typically varying from a couple of months to several years. Each payment is composed of both primary and interest, enabling consumers to gradually reduce their outstanding equilibrium. This predictable repayment timetable help in budgeting, as debtors understand precisely how much to allocate every month. Furthermore, numerous loan providers offer flexibility in settlement approaches, allowing consumers to select choices that ideal fit their financial situations. In general, the organized nature of installation financings makes them a convenient loaning option.Rates Of Interest Summary

Rates of interest play a crucial function in identifying the overall price of an installment finance. These rates, which can be taken care of or variable, influence the month-to-month payment amount and the overall interest paid over the lending term. A set rate of interest rate stays constant throughout the finance duration, supplying predictability in budgeting. On the other hand, a variable rate of interest may rise and fall based upon market conditions, possibly bring about greater or reduced settlements in time. Lenders analyze different variables, consisting of credit rating financing, income, and rating term, to determine the rate used to debtors. Understanding these rates is essential for borrowers, as they directly impact monetary preparation and the affordability of the car loan. Mindful factor to consider of the interest rate is important when picking an installation loan.Trick Terms to Know

One fundamental term is "major," which refers to the original amount obtained. "Interest" is the price of borrowing, expressed as a percent of the principal. The "car loan term" defines the duration over which the borrower consents to settle the financing.

Another vital principle is "month-to-month settlement," computed based on the principal, rate of interest, and car loan term. Customers ought to also understand "APR" (Yearly Portion Rate), which encompasses both the rate of interest and any kind of connected charges, giving a clearer photo of the total loaning expense.

"default" happens when a consumer stops working to fulfill settlement terms, potentially leading to charges or collections. Understanding these essential terms outfits customers to navigate their installment car loan choices properly

Pros and Disadvantages of Installation Loans

Benefits of Installation Loans

Installment financings come with both drawbacks and advantages, their structured settlement model typically appeals to borrowers seeking monetary stability. One substantial benefit is the predictability of regular monthly repayments, which enables borrowers to spending plan successfully. These car loans generally have repaired rates of interest, making it simpler to visualize complete expenses over the lending's duration. In addition, installation loans can assist construct credit report history, as timely link payments show favorably on credit history reports. Consumers may likewise access bigger amounts of money contrasted to typical credit alternatives, facilitating substantial acquisitions such as homes or lorries. This availability makes installment fundings an appealing choice for people looking for instant financing while maintaining convenient payment terms gradually.Drawbacks to Take into consideration

While installment loans use numerous benefits, there are significant downsides that potential debtors need to thoroughly think about. One considerable concern is the capacity for high rate of interest, particularly for those with bad credit scores, which can lead to substantial total repayment amounts. Furthermore, the taken care of monthly repayments can strain month-to-month budgets, especially throughout monetary hardships. Debtors might also deal with fines for missed out on repayments, which can further exacerbate their economic circumstance. Furthermore, the long-lasting nature of these financings can cause extended debt, restricting future borrowing capability (Cash Loans). Some people may find themselves in a cycle of financial debt if they continuously depend on installment car loans to manage their financial resources, making it crucial to assess their monetary wellness prior to dedicating to such responsibilities.Suitable Consumer Situations

Installment financings can be particularly beneficial for specific consumer situations, making it crucial to understand who might discover them advantageous. They are suitable for people seeking to finance significant expenditures, such as home renovations, instructional pursuits, or big acquisitions, as they supply predictable month-to-month payments gradually. Debtors with steady income and a good credit scores background can safeguard favorable terms, making repayment workable. These financings may not fit those with irregular earnings or bad debt, as they could face higher rate of interest rates or undesirable terms. Furthermore, consumers must beware of exhausting themselves, as missed settlements can result in significant monetary pressure. Ultimately, recognizing personal monetary circumstances will establish the viability of an installment finance.Factors to Think About Prior To Using

Before requesting an installation loan, possible debtors need to meticulously examine a number of vital factors. They should assess their credit rating, as it significantly affects finance eligibility and passion rates. A greater score commonly causes better terms. Next, consumers ought to consider their present financial scenario, consisting of income stability and existing financial debts, to determine their ability to take care of regular monthly payments.One more important element is the finance amount and term length. Borrowers should validate that the loan meets their requirements without exhausting their financial resources. In addition, it is important to evaluate the loan provider's reputation and customer service, as this can affect the borrowing experience. Comprehending the total cost of the financing, consisting of costs and rate of interest prices, will certainly assist debtors make educated decisions and prevent unpredicted economic burdens. By taking into consideration these factors, people can better navigate the process of getting an installment financing.

Often Asked Questions

Can I Settle an Installation Car Loan Early Without Penalties?

Yes, numerous installment financings enable very early repayment without fines. Terms can vary by loan provider, so it's important for debtors to examine their funding agreement to comprehend any type of potential costs connected with early benefit.How Does My Credit Rating Influence My Installation Lending Terms?

An individual's credit history significantly affects installment car loan terms. Greater ratings usually result in lower rate of interest prices and far better repayment conditions, while reduced scores may bring about greater rates and much less desirable terms for debtors.Are Installment Loans Available for Bad Credit Scores Borrowers?

Yes, installment financings are offered for bad credit consumers. These individuals might face greater passion prices and less beneficial terms due to viewed threat, making careful consideration of choices crucial prior to continuing.What Takes place if I Miss a Payment on My Installation Financing?

Missing out on a payment on an installation lending can bring about late fees, increased interest rates, adverse effect on credit report, and potential collection activities. Debtors are suggested to connect with lenders to discuss feasible remedies.Can I Get Numerous Installment Financings at When?

Yes, people can get several installment this article finances at the same time. Lenders typically analyze their creditworthiness, repayment capacity, and overall monetary circumstance prior to accepting extra car loans, making certain the borrower can manage several commitments without monetary stress.Installation lendings are a kind of funding that allows consumers to get a swelling sum of cash upfront, which they after that pay back over a collection period via scheduled settlements. Specialized fundings, such as getaway or wedding car loans, serve niche demands, allowing debtors to finance unforgettable experiences. Next off, borrowers fill up out a lending application, offering individual information and the preferred loan amount. Installment finances come with both downsides and benefits, their structured repayment version often allures to consumers seeking financial stability. These finances normally have taken care of passion prices, making it much learn the facts here now easier to predict overall expenses over the finance's duration.

Report this wiki page